The Arc Minnesota

Ask An Advocate

Blog

Events

Contact Us

About The Arc

Why The Arc?

Where We Work

Leadership

Our Partners

Ways We Can Help

Learn & Connect

Learning Center

Public Policy

Get Involved

Including and supporting people who have disabilities

The Arc Minnesota promotes and protects the human rights of people with intellectual and developmental disabilities. People with disabilities and their families trust The Arc for information, assistance, education, and public policy leadership.

We are also committed to providing our community with essential legal documents. One essential document for people with intellectual and developmental disabilities is the power of attorney (POA). Our POAs are lawyer-approved, so everyone who needs to create this document can be sure they will get a quality one.

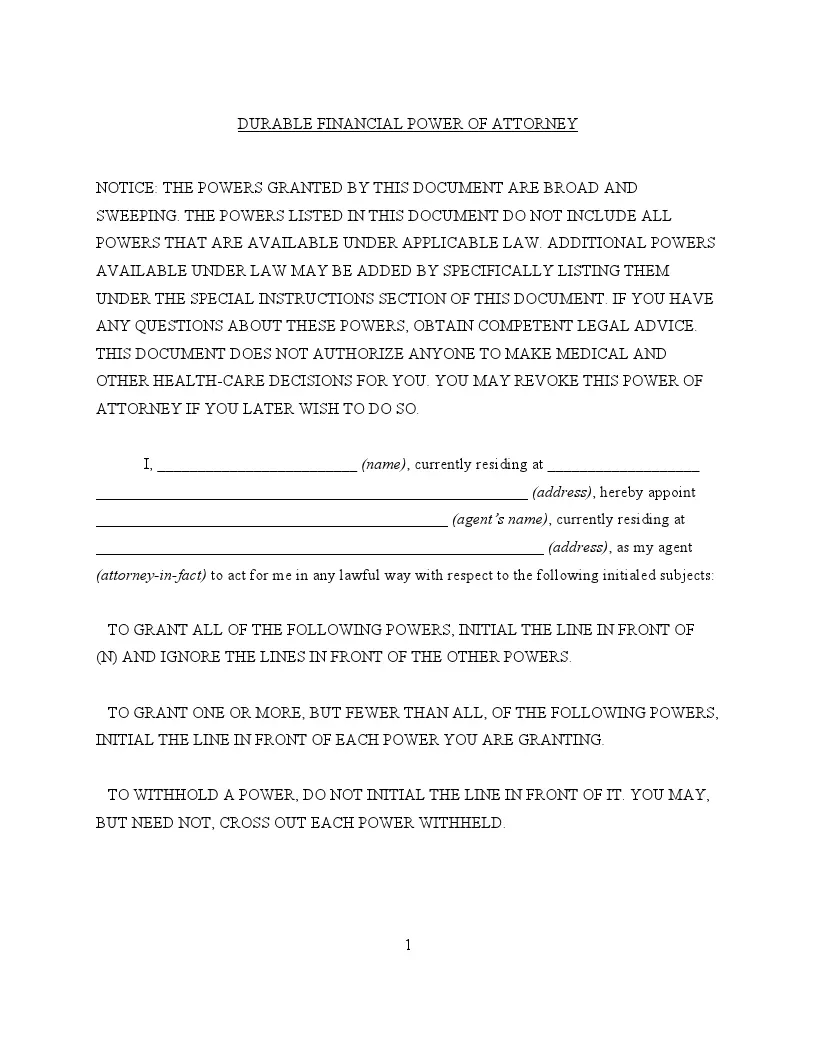

Power of Attorney Forms

Power of attorney forms help assign someone to take care of your financial or health care matters for you. Of course, not every person with intellectual or developmental disabilities is incompetent to make these decisions. Still, they may want to have some assistance in handling a part of complex matters. A power of attorney allows you to appoint your parent, spouse, or friend to be your agent or attorney-in-fact to help you. You should choose the POA type depending on the matter you need assistance with.

The most widely used power of attorney is a durable power of attorney template. It provides the agent with authority to act on behalf of the principal if the latter becomes incapacitated. A durable POA serves as an indispensable estate planning tool to ensure that any of your property or financial matters will be handled properly if you become incapacitated.

Another essential POA type is ahealth care power of attorney. It’s a type of advance directive allowing individuals to appoint their health care proxy or surrogate. The appointed proxy is expected to handle the principal’s health care issues if the latter is incapacitated or has a terminal condition.

Sometimes, you may need to occasionally use a power of attorney only in specific circumstances or on a specific date. In this case, you may use a specific power of attorney form. As the name implies, the agent’s powers are limited to certain actions or a certain period of time. A limited POA may be useful if the principal is abroad but has the meeting to attend or the contract to sign. With a power of attorney, the agent will easily deal with the task.

A generic power of attorney form is used when the principal wants to grant the agent with a wide range of powers. However, it doesn’t mean that with the general POA, your attorney-in-fact will have the right to do what they want with your assets or property. POAs do not grant full financial rights, and the agent must always act in the principal’s best interest.

Browse Power of Attorney Forms by Type

You may appoint another person to also represent you before the Internal Revenue Service (IRS) using a specific Form 2848 for such authorization. There are also power of attorney for minor allowing you to appoint a temporary caretaker of the child. If you need to sell your used car but cannot do it independently, a power of attorney for motor vehicle will come in handy. As you can see, a power of attorney can cover almost every unique situation. We’ve gathered all the essential POA types below for your convenience.

- Power of Attorney for Minors

- Internal Revenue Service POA

- Power of Attorney for Cars

- Real Estate Power of Attorney

- Power of Attorney for State Taxes

Sample Power of Attorney:

Power of Attorney Forms by State

As a rule, a power of attorney signed in one state will be valid in another. The Uniform Power of Attorney Act (UPOAA), adopted by 26 states, contributes to it. However, governing laws may differ from state to state. That’s why you are always recommended to consult your local requirements and choose a state-specific form.

California residents may use a California POA to appoint someone who will manage their affair temporary or on a daily basis. This form is general and will become ineffective if the principal is incapacitated. To make it durable, you can add special instructions in the document. California statute governing the POA issues is CA Prob Code – Division 4.5 Powers of Attorney (4000-4545).

In Texas, you are expected to prepare a Texas POA. This form is equal to a general power of attorney. If you need a specific form, you should look through the list down below. Texas statutes governing POAs are Title 2, Chapter 751 (Durable Power of Attorney Act) & Chapter 166 (Advance Directives Act).

A New York POA will be useful if a person needs assistance in financial or real estate matters. Note that if you appoint the agent to make real estate decisions, you will have to notarize your power of attorney. New York statute governing POA documents is GOB Article 5, Title 15.

Other POA forms are listed below:

- Alabama

- Alaska

- Arizona

- Arkansas

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Utah

- Vermont

- Virginia

- Washington State

- West Virginia

- Wisconsin

- Wyoming

Some of the State Power of Attorney Forms by Type

Every power of attorney must contain such information as the principal’s and agent’s details, powers to be granted, special instructions, execution date, and durability. The document should be signed in the presence of a notary public or two competent witnesses. But as mentioned above, it’s also crucial to prepare your power of attorney based on the state requirements and rules. We’ve created a list of different state-specific POA templates considering the document’s type to facilitate your task even more. If you are looking for a specific POA form, the list below is for you.

- Arizona Durable Power of Attorney

- Arizona Medical Power of Attorney

- California Durable Power of Attorney

- California Medical Power of Attorney

- Colorado Durable Power of Attorney

- Colorado Medical Power of Attorney

- Florida Durable Power of Attorney

- Florida Health Care POA

- Georgia Durable Power of Attorney

- Georgia Health Care POA

- Idaho Medical Power of Attorney

- Illinois Durable Power of Attorney

- Illinois Medical Power of Attorney

- Indiana Durable Power of Attorney

- Indiana Medical Power of Attorney

- Kansas Durable Power of Attorney

- Maine Medical Power of Attorney

- Maryland Durable Power of Attorney

- Maryland Health Care Power of Attorney

- Massachusetts Durable Power of Attorney

- Massachusetts Health Care Power of Attorney

- Michigan Durable Power of Attorney

- Michigan Medical Power of Attorney

- Minnesota Medical Power of Attorney

- Missouri Durable Power of Attorney

- Missouri Medical Power of Attorney

- New Jersey Durable Power of Attorney

- New Jersey Medical Power of Attorney

- New York Durable Power of Attorney

- New York Medical Power of Attorney

- North Carolina Durable Power of Attorney

- North Carolina Medical Power of Attorney

- Ohio Durable Power of Attorney

- Ohio Medical Power of Attorney

- Oklahoma Durable Power of Attorney

- Oregon Durable Power of Attorney

- Oregon Medical Power of Attorney

- Pennsylvania Durable Power of Attorney

- Pennsylvania Medical Power of Attorney

- South Carolina Durable Power of Attorney

- South Carolina Health Care Power of Attorney

- Tennessee Durable Power of Attorney

- Texas Durable Power of Attorney

- Texas Medical Power of Attorney

- Utah Medical Power of Attorney

- Virginia Durable Power of Attorney

- Virginia Medical Power of Attorney

- Washington State Durable Power of Attorney

- Wisconsin Power of Attorney for Health Care

You are free to revoke any of your POAs using a Power of Attorney Revocation Form. You may revoke the POA when you want to change the agent due to an irrelevant task or improper performance of the obligation. A revocation form should be signed before a notary public.

Supporting Families Across Minnesota

The Arc Minnesota and affiliated chapters provide consistent and essential services to people with disabilities and their families. The Arc Minnesota’s services throughout the state include access to real-time assistance and information, online and in-person training events, and a statewide public policy platform involving people at a grassroots level.

22% of calls to The Arc Minnesota are questions about navigating funding and government services such as Social Security.

90% of survey respondents agreed that The Arc helped them advocate for themselves or their loved one and said they would contact us again for support.

“For more than 50 years, The Arc has been there for my brother and my family.”

When the future feels uncertain and we’re unsure what our next steps will be, it’s comforting to know that The Arc’s caring and informed Advocates are a phone call away.

Ways We Can Help

People with intellectual and developmental disabilities (I/DD) and their families contact The Arc for information and personal support. Advocates at The Arc have the experience and knowledge to help you. Select a topic below for more information.

Arc Guides

The Arc Guides (pdfs) provide helpful information on a wide range of topics. The most frequently requested Arc Guides have been translated into Spanish. Feel free to make copies. If you reproduce information from the Arc Guides, please credit The Arc Greater Twin Cities.

Ask An Advocate

The Arc provides one-to-one intensive support for adults with disabilities and family members. Advocates at The Arc provide free consultation by phone, email or in person.

Abuse Prevention

Individuals with disabilities are at far greater risk for abuse than people without disabilities. The Arc provides training and resources for people with disabilities and those who support them.

Community Engagement

The Arc creates connections for parents, caregivers, and siblings through networking groups and civic engagement opportunities.

Education

Special education advocacy addresses academic issues and participation in the school community. Advocates provide coaching, strategies and information to empower parents and guardians to advocate for their family member.

Employment

The Employing People with Disabilities Video Series and Resources provides employers with valuable information to expand the diversity of workforces and positively impact organizations. The program also offers valuable information for individuals seeking employment.

Government Benefits

The Arc can help in determining eligibility and applying for government benefits that are available to individuals with intellectual and developmental disabilities including Personal Care Assistance (PCA), Social Security and Waivered Services.

Guardianship

When an individual turns 18, they are considered a legal adult and their own guardian whether or not they have a disability. The Arc assist families in learning the basics of guardianship.

Health Care Assistance

The Arc provides support in obtaining Medical Assistance and navigating the health care system. Advocates at The Arc are certified MNsure Navigators who can help you understand and apply for benefit programs.

Housing

People with intellectual and developmental disabilities and their families face many barriers in finding a housing option that works best for them. The Arc provides resources and assistance in finding or maintaining affordable, integrated housing in the community.

Planning Your Future

The Arc has many different planning options that use a person-centered approach including FutureLife Options™, a comprehensive planning for the future of a person with a disability.

Self-Advocacy

Self-advocacy is about speaking up for yourself and the things that matter to you. The Arc provides leadership development and public policy engagement for adults with disabilities.

Healthcare Assistance

Medical Assistance is the way many families of children and adults with disabilities pay for services, like Personal Care Assistance (PCA) and waivers. It is also a starting point in applying for a waiver. MNsure is Minnesota’s health insurance exchange and the “front door” where most Minnesotans apply for healthcare programs like Medical Assistance, MinnesotaCare, Qualified Health Plans (QHPs, private insurance plans) and financial assistance to purchase these QHPs. Read more: Understanding MNsure. Some people with disabilities apply for healthcare programs through MNsure while others apply directly through their county of residence.

HOW CAN THE ARC HELP?

Many people struggle with applying for Minnesota Health Care Programs, including Medical Assistance. The Arc Greater Twin Cities can provide information to assist you in choosing and applying for the coverage you need. Advocates will provide tools to guide you through the application process and facilitate communication with your county and the state.

WHO IS ELIGIBLE FOR ASSISTANCE FROM THE ARC?

The Arc provides information about health care access to individuals with intellectual and developmental disabilities and their family members living in the same household within the 7-county metro area.

HOW DO WE HELP?

Advocates at The Arc are available to answer questions about:

- MNsure, including Insurance Affordability Programs (Medical Assistance, MinnesotaCare, Qualified Health Plans).

- Healthcare programs specifically designed for people with disabilities, (MA-TEFRA, MA for Employed Persons with Disabilities and Special Needs Basic Care).

- Parental fees for the MA-TEFRA program.

- Disability certifications through the State Medical Review Team.

- Covered services.

- How private insurance works with Medical Assistance and the county’s private insurance review process (called “Cost Effective Health Insurance”).

- Evaluating your options, and helping you determine how to apply for coverage (through MNsure or directly through a county using a paper application).

- Renewals for healthcare programs.

Government Benefits

The Arc can help with government benefits available for individuals with intellectual and developmental disabilities.

SOCIAL SECURITY INCOME

Supplemental Security Income (SSI) is a Social Security Administration program that gives funding to people with disabilities who have limited income or assets. SSI makes cash assistance payment to persons who are aged, blind or disabled and who have limited income.

PERSONAL CARE ASSISTANCE

Personal Care Assistance (PCA) services provide assistance to an individual with a disability who needs help with activities of daily living (ADLs). To be eligible for PCA services you need to be eligible for Medical Assistance and go through your county’s MNChoices Assessment process.

HOME AND COMMUNITY BOARD WAIVERS (HCBS)

Some people require additional services beyond what’s covered under standard Medical Assistance (MA). Minnesota’s MA-Waiver Programs are designed to serve those people and provide the services necessary to allow them to live in the community. Not all people with disabilities will qualify for a MA-Waiver program; each program serves a different target population and has its own eligibility criteria. Here are MA-Waiver programs available to Minnesotans with disabilities:

- Developmental Disabilities (DD) Waiver provides services to people with developmental disabilities or related conditions who qualify for Medical Assistance (MA). These services help people live in the community instead of in an Intermediate Care Facility for Persons with Developmental Disabilities (ICF/DD).

- The Community Alternatives for Disabled Individuals (CADI) Waiver serves people with disabilities who need the level of care offered in a nursing facility.

- The Developmental Disabilities (DD) Waiver provides services to people with mental retardation or related conditions.

- The Community Alternative Care (CAC) Waiver provides services to people who are chronically ill and need the level of care provided in a hospital.

Each of these waivers offer different services based on the population served. All offer Personal Care Assistant services, extended home health aide and nursing services, extended homemaker services, medical equipment and supply services and increased transportation services.

Guardianship

WHAT IS GUARDIANSHIP?

An individual is considered a legal adult and their own guardian when they turn 18, whether or not they have a disability. Individuals have full rights and responsibilities unless guardianship is established.

Guardianship is a substitute decision making process put into action by the probate court and a judge. This is appropriate for individuals who struggle making safe and healthy decisions without assistance. Alternative and less restrictive options should always be considered when thinking about guardianship.

IS GUARDIANSHIP RIGHT FOR ME?

Consider guardianship if an individual cannot make safe and healthy decisions independently, and if less restrictive alternatives do not ensure well-being. If families worry about the vulnerability of their loved one, guardianship and its alternatives should be considered. Everyone has a right to make mistakes and make their own choices in life. Guardianship is a way for a person to work with an individual to ensure what they want is considered and their decisions are within their best interest.

HOW CAN I LEARN MORE?

- Watch the “The Top 8 Things to Consider in Guardianship” created by The Arc Greater Twin Cities to assist families in learning the basics of guardianship.

- Read this Arc Guide to Guardianship created to help families learn and understand complicated systems.

- Review The Arc of the US position statement on guardianship.

- Watch this video created by Hennepin County which does a wonderful job of explaining guardianship and what guardianship means for families.

- Ask an Advocate! The Arc’s advocates can assist families in understanding the guardianship process, getting connected to the correct places, giving resource lists and helping learn and understand required annual paperwork.

Planning Services

The Arc Greater Twin Cities has many different options to help you plan for your loved one’s future. All of our options use a person-centered approach.

“Person Centered Planning discovers and acts on what is important to a person. It is a process for continual listening and learning, focusing on what is important to someone now and in the future, and acting on this in alliance with their family and their friends.” – Thompson, Kilbane, & Sanderson

FutureLife Options™ (Formerly the Lifetime Assistance Program)

FutureLife OptionsFamilies of people with disabilities often ask themselves, “What will happen to my loved one when I’m no longer here?” They want the future to be secure and happy, but they may not know exactly what that future looks like or how to reach it. FutureLife Options starts by asking what a good life would be for the person with a disability, then focuses on how to make it happen.

Transition Vision Project

TVPThe Transition Vision Project is about dreaming AND doing. It starts by helping students with intellectual and developmental disabilities and their families paint a picture of the future they want. Then it helps them create a step-by-step plan for reaching that future, starting with actions that can go to work immediately in the student’s Individualized Education Program (IEP).

Person-Centered Plans

Ron-WilliamsSometimes you want a plan for a specific purpose. Our general Person-Centered Planning utilizes a variety of person-centered planning approaches. In particular, we use a hybrid approach of Personal Futures Planning and Essential Lifestyle Planning. This approach covers all areas of life for the individual as well as meets the requirements of the Jensen settlement, as well as the intentions of the Olmstead plan.

Transition to Adulthood: A Future Planning Workbook

If you have a child with an intellectual or developmental disability who is making the transition from school to adult life, you have a lot to consider — government benefits like Social Security and Medicaid, legal issues like guardianship, and life issues like employment and housing. Transition to Adulthood: A Future Planning Workbook is a guide that helps families make decisions and track documents as they work through transition issues. It’s designed as a self-help tool, although personal assistance is available if needed.

Tyze: Personal Networks

Tyze is an online tool that brings people together around an individual, creating a community of support. Tyze is a simple way to get organized and keep everyone informed.

Community Engagement

Effective community engagement enables The Arc GTC to make more informed decisions. By receiving diverse perspectives and potential solutions the quality of decisions improves and a higher standard of customer service is provided. Community engagement on all levels enhances a communities of understanding of disability related issues and how the community can come together to solve the issues.

People who live, work, and use The Arc GTC’s supports have a range of local knowledge and expertise that should be utilized to inform and influence decisions made within the community that impact them.

The Arc Greater Twin cities is available to help people with intellectual and developmental disabilities and their families across the lifespan-from early childhood to school age, during the transition to adulthood, to ensuring a safe and secure senior life. The Arc can provide workshops and presentations on topics such as housing, person-centered thinking and planning, education, health care, accessing services, self-advocacy and others.